“If you do not change direction, you may end up where you are heading” ― Buddha

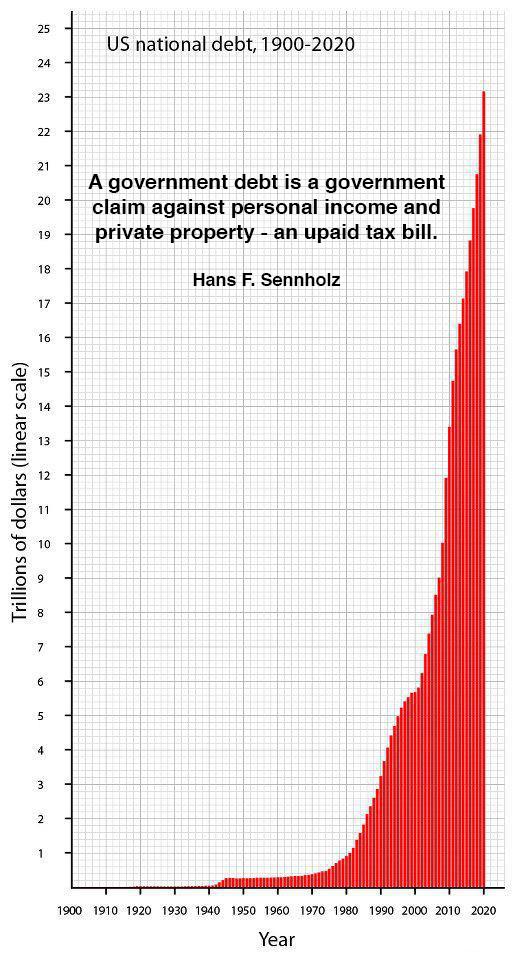

Things that can’t go on forever, won’t. Debt that can’t be repaid, won’t be.

Promises that can’t be kept, won’t be. — Glen Reynolds

I started the new year off wrong by watching our leaders ‘solve’ the fiscal cliff crisis. To make things worse, I watched some of them make speeches afterward, patting themselves on the back for their great work. The President spoke and was pleased with himself and with the legislators for achieving the “balanced approach” that he had demanded and for taking important steps to cut the deficit that he cares so much about. And then he flew to Hawaii for more vacation.

What a contemptible group of short-sighted posturing fools we have in Washington. We can count on them not to do the right thing. The ‘balanced approach’ in this bill gave us $41 dollars in new taxes for every dollar of budget cuts. And the bill authorizes new spending that consumes over half of the projected new revenue. There’s pork for Hollywood, pork for windmills, pork for algae and Nascar. It’s dirty business as usual. 77% of taxpayers will see an increase in their tax burden. This is how Obama is protecting the middle class.

There were a few lawmakers who spoke the truth during the deliberations. They discussed our government’s out-of-control spending, they discussed the consequences of our staggering debt and they discussed the consequences for our grandchildren. These are the people characterized as fringe extremists, Tea Party types, the ones who don’t want to compromise for the good of the country. And by compromise, they mean spend wildly like there is no tomorrow. Expand government.

Can we tax and spend our way out of our economic problems? Who could possibly believe that? Even the projected revenue from this legislation will only run our bloated government for a few days. And it is likely that the legislation will actually reduce business activity and thereby reduce revenue.

We are in an economic death spiral. If we don’t change direction, we will end up where we are heading. The majority of our legislators either don’t see this, or don’t care. Obama clearly wants to go full speed ahead in our current direction. There is no reason at all to believe that he cares about big spending and the exploding deficit. The mainstream media are lemmings who will blindly and obediently follow him over the debt cliff …leading their unthinking followers.

Too often, political stories are reported like a sporting event. Which party is going to win the battle today? By focusing on today’s skirmish, the big picture is ignored. But, it’s not about them. It’s about us. The relevent thing is not whether something helps or hurts Obama. The relevant thing is our children’s future; our country’s future.

You and I know that our country is in peril. The government’s many obligations that cannot be paid will not be paid and there will be consequences. The longer we wait to face this, the worse the consequences. But there are people who see economic collapse as a good thing. The followers of the Cloward-Piven Strategy are so immersed in this socialist utopian delusion that they seek an economic collapse, assuming that a wonderful socialist world will arise from the ashes. There are powerful people who have this belief. This strikes me as very similar to the delusion of those who committed suicide to join paradise on the Hale-Bopp comet.

I’ll end today’s post with a couple of paragraphs from Michael Auslin at NRO:

… we have crossed the Rubicon of political reality. The president holds a cheerleading session to ridicule Congress, not one plan offered makes even the smallest dent in our economic disaster, cynical political ploys by Harry Reid torpedo possible agreements — all these petty politicians fiddle while America burns. And then, we’re supposed to believe that a last-second deal responsibly solves the problem from a bunch of bickerers who had months (years, really) to tackle the issue?

Our crisis is political, not economic. Politics is ultimately a moral exercise, no matter what it deals with. Leaders are stewards of our social patrimony. What we see in Washington today is not gridlock. It is collapse. It is the final triumph of political theater over political reality, of ignorance over reasoned governing, of self-interest over principle. A $12 trillion economy and 230-plus-year history can survive a great deal of abuse and neglect. But history proves no state is immune from the self-inflicted idiocy of its leaders or people. Just how long we will survive in this state is now a proposition fully engaged. It is the great social experiment of the 21st century

. That’s over $360,000 in debt per citizen.

. That’s over $360,000 in debt per citizen.

In a column entitled

In a column entitled