Mr. Pinard, a good friend and small business owner in Texas, was talking to me recently about the frustration of having to watch the mud-slinging between the two presidential candidates. In the melee of gaffs, gotcha commercials, and character attacks, he noted that no one was talking about the worst threat to our future: the debt. Mr. Pinard has to make sure that his books are balanced 365 days a year. If he were to fail to bring in more revenue than he spends, he would have to slow the growth of his company and even fire people. If the problem were to persist, he would go out of business. The only difference between Mr. Pinard’s home health business and the US is the timeline. Mr. Pinard doesn’t have a Ben Bernanke there to bankroll poor management and pass judgement day to a future generation.

The delay between action and consequence is the only reason that democrats are still taken seriously today. Like a spoiled child gambling in Las Vegas, they have little concern or awareness of the bills they are racking up. Even the president of the United States couldn’t answer how much his country owes to lenders. When confronted, Obama and other democrats use a reliable excuse they’ve been using for decades ”the debt doesn’t pose a short-term problem”.

That is no longer the case. On Sunday, Bryce wrote a great article describing how the debt not only poses a threat to our economy, but also our national security. The threat is no longer a problem for our children and grandchildren. It is our problem now. Thanks to the rapidly accelerated spending started under Bush and carried on by Obama, our day of reckoning is only one or two presidential terms away. It begins as soon as the Fed raises interest rates:

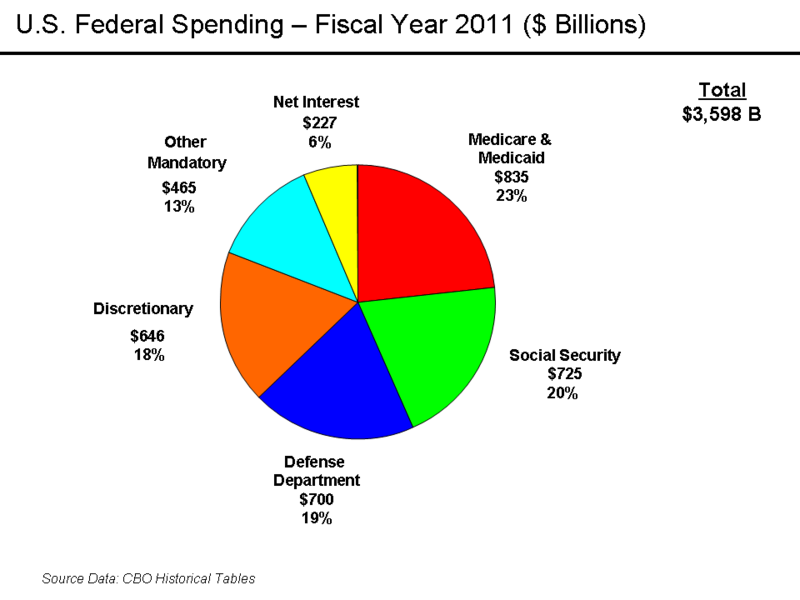

The following graph is the federal budget in 2011 as per the CBO:

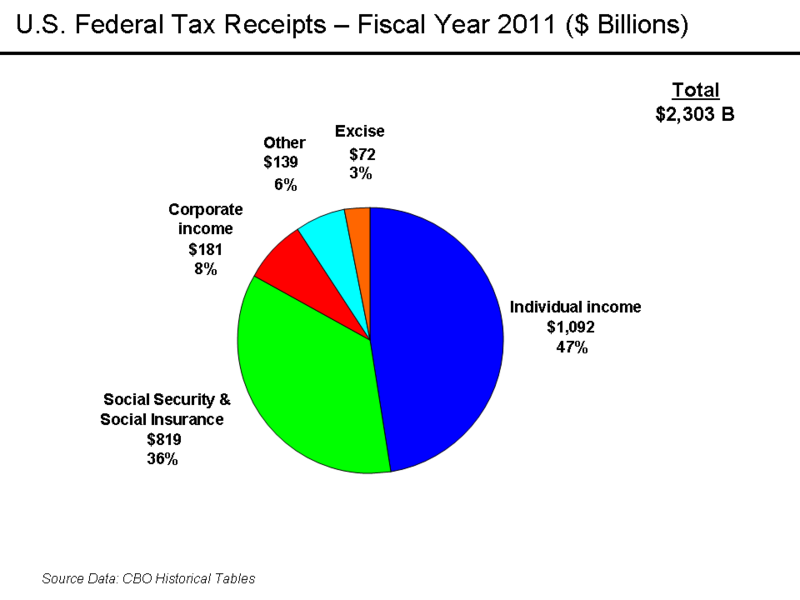

And the following are the tax reciepts for 2011:

When looking at the above graphs of the US balance sheet, two things stand out:

- There is a gap of $1.295 trillion between the numbers. The wealthiest nation in the world was taxed at one of highest rates (in relation to GDP) in its history in 2011 and produced $2.303 TRILLION for our masters to do what they need to do. They ended up spending 156% of that amount. This has been the story since 2008 and isn’t giving any sign of letting up soon.

- The graph doesn’t include Obamacare and the extra $500 billion of additional annual interest we’ll be paying by 2018, after the fed raises interest rates to more “normal” levels. Austerity anyone? Who and what are we cutting to make this happen? Social Security? Medicare? Infrastructure?

This isn’t a lofty discussion of politics or conjecture. It is simple math. By the time your kids entering college are out looking for a job, we will be facing Greece-like cuts. Your money will be going toward a return for Chinese debt holders, not updating the bridge you cross every day or hiring a teacher at your local school.

The two pies presented above should be in the back of our minds every time a politician speaks. This our balance sheet. Ask yourself how long we could survive spending 156% of what we make… because that is exactly what each and every one of us is doing right now.